Understanding Filial Responsibility Laws: Who Will Pay for the Care?

Filial responsibility laws make adult children financially responsible for their parents' long-term care if the parents can't pay. These laws exist in 27 states and can impose civil or criminal penalties. Planning and legal advice can help avoid this financial burden.

Do you know that you might be legally responsible for the long-term care costs of your aging parents? Filial responsibility laws, which exist in over half of the U.S. states and in some countries worldwide, impose a legal obligation on adult children to financially support their indigent parents. These laws have evolved through history and have significant implications for families today.

In this blog post, we’ll explore the origin and purpose of filial responsibility laws, how they work, and the differences between states with active laws. We’ll also discuss the role of Medicaid and strategies to manage filial responsibility obligations, along with real-life cases and international perspectives. By the end, you’ll have a solid understanding of filial responsibility laws and how they may impact you and your family.

Short Summary

- Filial responsibility laws have been around since 1601, varying between states and countries with some having criminal penalties for noncompliance.

- Adult children are legally obligated to provide basic needs for their parents in accordance with these laws that vary depending on the family’s financial situation.

- It is important to understand specific filial responsibility laws in your state as well as Medicaid eligibility requirements and long term care planning options available.

The Origins and Purpose of Filial Responsibility Laws

Filial support laws, which require adult children to financially support their impoverished parents, can be traced back to the Elizabethan Poor Law of 1601. This law laid the foundation for modern filial responsibility laws, which now vary between states and countries, and may even include criminal penalties for noncompliance.

Elizabethan Poor Law of 1601

The Elizabethan Poor Law, also known as the Poor Relief Act 1601, was enacted during the reign of Queen Elizabeth I to provide relief and welfare for those suffering from poverty and economic depression. It appointed overseers of relief to manage money collected through taxes, ensuring that each parish could support those who were unable to help themselves.

The law established the idea that family members should take responsibility for financially supporting their impoverished relatives, including elderly parents.

Evolution and Modern Application

Over the years, filial responsibility laws have evolved, and while many states repealed them following the introduction of Medicaid, 26 states and Puerto Rico still maintain these laws. However, the enforcement and consequences of these laws differ from state to state and may include criminal penalties for non-compliance.

Filial responsibility laws also exist in other countries, such as France, where close relatives are legally required to support each other when needed, including covering a parent’s medical bills. In Germany, children have an obligation to support their impoverished parents. The enforcement of these laws varies, with some countries rarely enforcing them and others imposing severe penalties for noncompliance.

How Filial Responsibility Laws Work

Filial responsibility laws impose a legal obligation on adult children to support their parents when they are unable to cover their own basic needs such as food, clothing, shelter, and medical care. The extent of this support and the circumstances under which it is required can vary between states, depending on factors like the parent’s age and the adult child’s financial situation.

The baby boomer generation, as they age, will need more long-term care services. This may lead to an upsurge in the enforcement of filial support laws, as a way for care providers to recoup costs for providing elderly care. This makes understanding filial responsibility laws and their implications even more crucial for today’s adult children.

Financial Support for Indigent Parents

Under filial responsibility laws, adult children may be required to pay for their parents’ necessities, including long-term care expenses and parent’s medical bills. In most states, families with low-income are exempt from these laws, and sometimes even middle-class families may be exempt if their parents meet the requirements for Medicaid.

The extent of financial support required can differ from state to state, and in some cases, responsibility for financially supporting indigent relatives may fall on the spouse, parents, and then the adult children.

Legal Action and Penalties

Failing to fulfill filial responsibility obligations can result in serious legal consequences, such as wage garnishment, bank account seizure, and even imprisonment. In some states, nursing homes and government agencies can take legal action to recover the costs of care provided to elderly parents if their adult children fail to provide the necessary financial support.

The penalties for noncompliance differ depending on the state, with some states imposing fines and others resorting to criminal charges.

Filial Responsibility Laws Across States

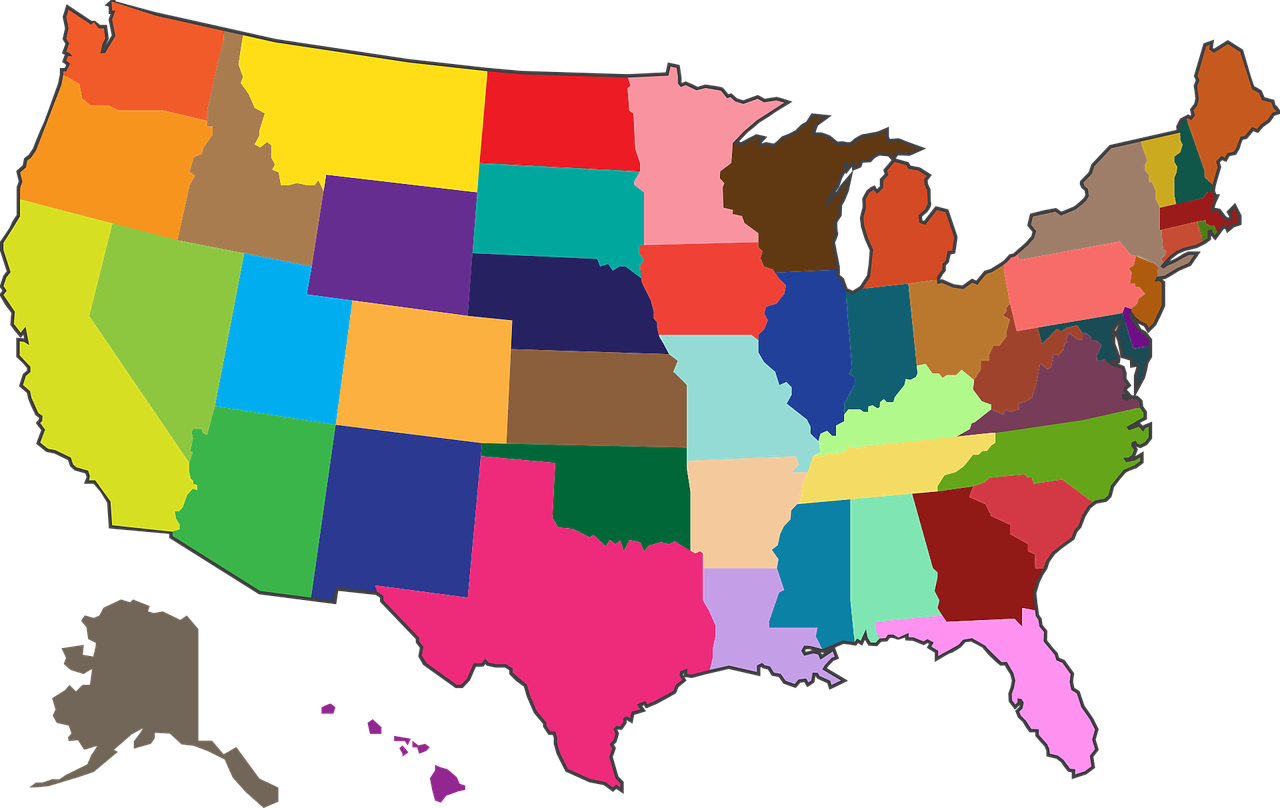

Although more than half of the U.S. states maintain filial responsibility laws, these laws are not uniform across the country. Different states have different rules regarding the extent of support required, the penalties for noncompliance, and how responsibility is shared among family members. One example of such legislation is the Pennsylvania filial responsibility law, which has its own unique set of guidelines and enforcement mechanisms.

It’s essential to understand the specific filial responsibility laws in your state and how they may apply to your family situation. Familiarizing yourself with the laws in your state can help you better prepare for potential legal and financial consequences, as well as plan for the long-term care needs of your aging parents.

States with Active Laws

Currently, 26 states with filial responsibility and Puerto Rico have active filial responsibility laws. These states include Alaska, Arkansas, California, Connecticut, Delaware, Georgia, Idaho, Indiana, Iowa, Kentucky, Louisiana, Massachusetts, Mississippi, Montana, Nevada, New Hampshire, New Jersey, North Carolina, North Dakota, Ohio, Oregon, Pennsylvania, Rhode Island, South Dakota, Tennessee, Utah, Vermont, and West Virginia.

Each state has its own specific rules and regulations regarding filial responsibility, and it is important to understand the laws in your state in order to be prepared for potential legal and financial responsibility consequences.

Differences in State Laws

State laws differ in terms of the extent of support required, penalties for noncompliance, and how responsibility is shared among family members. For example, in Indiana, adult children are expected to provide financial support for their parents if either parent is unable to cover the costs of their own basic needs such as food, clothing, shelter, and medical care.

In South Dakota, adult children must be notified before they can be held responsible for their parents’ care. It’s crucial to be aware of the specific filial responsibility laws in your state and how they may apply to your family situation.

Family members and filial responsibility law

Medicaid and Filial Responsibility

Medicaid, a federal and state program that provides health insurance to those with low incomes, plays a significant role in filial responsibility. In some states, if an elderly parent qualifies for Medicaid, they may not be subject to filial responsibility laws, as Medicaid can help cover their long-term care expenses.

However, it’s important to be aware of the Medicaid Estate Recovery Program, which allows states to recoup costs from the estates of deceased Medicaid recipients, potentially affecting shared assets between parents and children.

Understanding the role of Medicaid and eligibility requirements is crucial when navigating filial responsibility laws and protecting your family’s assets.

Medicaid Eligibility

Parents who qualify for Medicaid may not be subject to filial responsibility laws, as Medicaid can cover their long-term care expenses. Medicaid eligibility is based on federal law and can differ from state to state, with each state having its own criteria and income limits. Generally, people who are low-income, pregnant women, children, and individuals with disabilities may be eligible for Medicaid.

To determine if your parents qualify for Medicaid, you’ll need to check the specific criteria set by your state’s Medicaid program.

Medicaid Estate Recovery Program

The Medicaid Estate Recovery Program is a federal program that allows states to recover Medicaid payments from the estates of deceased Medicaid recipients. This means that, in some cases, shared assets between family members, like a home or bank account, may be at risk as states seek to recoup the costs of care provided to elderly parents.

Being aware of the Medicaid Estate Recovery Program and its potential impact on shared assets can help you make informed decisions about your family’s financial future.

Strategies to Manage Filial Responsibility Obligations

Managing filial responsibility obligations requires being financially responsible through proper financial planning and seeking legal assistance. By engaging in financial planning, discussing long-term care options with your parents, and consulting with legal professionals, you can minimize potential legal and financial consequences related to filial responsibility laws.

Being proactive and staying informed about the filial responsibility laws in your state, as well as available financial resources and assistance programs for long-term care, can help you better prepare for your legal obligations and protect your family’s financial future.

Financial Planning and Long-Term Care

Engaging in financial planning and discussing long-term care options with your parents can help avoid filial responsibility issues and potential medical debt battles. This may involve getting involved in your parents’ financial planning, investing in long-term care insurance, speaking with your parents about estate planning, and working together as a family to develop a plan for handling long-term care expenses.

Additionally, familiarizing yourself with available financial resources and assistance programs for long-term care, such as Medicaid, can help you better understand your options and potential obligations.

Legal Assistance and Resources

Consulting with an elder law attorney can provide guidance on navigating filial responsibility laws and protecting assets. An attorney can help you understand the specific laws and resources available in your state, as well as provide legal advice on how to best manage your filial responsibility obligations. They can also assist you in staying informed about any changes in filial responsibility laws that may affect your family’s financial situation.

Seeking legal assistance early on can help minimize potential legal and financial consequences related to filial responsibility laws.

Real-Life Cases and Examples

Real-life cases and examples of filial responsibility laws in action can provide insight into how these laws are enforced and their implications. By understanding how these laws have been applied in different situations, you can better prepare for potential legal and financial consequences and protect your family’s assets.

These examples can help you understand the scope of filial responsibility laws and how they may affect you.

Pennsylvania Filial Responsibility Case

In a notable Pennsylvania case, a son was sued by a skilled nursing facility for his mother’s care costs under the state’s filial responsibility law. The case highlights the potential financial consequences adult children may face if they fail to provide the necessary support for their parents’ long-term care expenses.

This example serves as a cautionary tale for adult children to be proactive in planning for their own or her parents’ long-term care needs and understanding their legal obligations under filial responsibility laws.

International Perspectives

Filial responsibility laws also exist in other countries, such as Canada, Germany, France, and some Asian countries, with varying degrees of enforcement and consequences. In Germany, for example, filial responsibility laws are rarely enforced, and the consequence is usually a fine.

In France, such laws are more strictly enforced and may involve imprisonment. In some Asian countries, filial responsibility laws are strictly enforced, with severe consequences ranging from imprisonment to even death.

Understanding international perspectives on filial responsibility laws highlights the global importance of being aware of your legal obligations and planning for your family’s long-term care needs.

Summary

In conclusion, filial responsibility laws have deep historical roots and continue to impact families today. Understanding these laws, how they work, and their implications is essential for adult children who may be responsible for their parents’ long-term care expenses. By engaging in financial planning, seeking legal assistance, and staying informed about available resources and assistance programs, you can better manage your filial responsibility obligations and protect your family’s assets.

As the baby boomer generation continues to age and long-term care needs increase, it’s crucial to be proactive and prepared to navigate the complexities of filial responsibility laws. By taking the time to understand these laws and plan for your family’s future, you can help ensure the well-being of your aging parents and protect your family’s financial stability.

Here is a link to learn more about this : Filial Support Laws in the Modern Era: Domestic and International Comparison of Enforcement Practices for Laws Requiring Adult Children to Support Indigent Parents

Update

Filial responsibility abusive parents/ filial responsibility estranged parent

The filial responsibility laws are controversial, as the adult children may not have had any contact with their parents in decades. This has recently happened to a woman from California who was sued by her father’s nursing home when he was unable to pay his bills. She had been estranged from him since childhood and had no idea that she could be held legally responsible for his debts.

In states with this law, it is important to know your rights and obligations as an adult child of a parent who is not able to take care of themselves. It’s important to know when you can be held financially or morally responsible for the parents’ debt and how much responsibility you have.

A parent's debt, such as medical bills , nursing home care costs and other necessary living expenses, could be your responsibility. You may also be responsible for any debts that are inherited from the parent's estate. It is important to consult with a lawyer if you find yourself in this situation to understand your rights and obligations under the law.

More than half of all states have some form of filial responsibility laws on the books, but these laws vary by state. It is important to check with your state's governing body in order to understand what you may owe if your parent passes away or requires long-term care that they cannot pay for. Knowing these laws can help protect you from being held liable for your parents' debts.

*The states with filial responsibility laws are

*States with a filial responsibility law: Arkansas, California, Connecticut, Delaware, Georgia, Indiana, Iowa, Kansas, Kentucky, Louisiana, Maryland, Massachusetts Mississippi Montana New Hampshire New Jersey Ohio Oklahoma Oregon Pennsylvania Rhode Island South Dakota Tennessee Utah Vermont West Virginia and Wyoming. Additionally the District of Columbia also has such a law in place.

Here is a list of updated statutes on the filial responsibility laws.

Filial Responsibility and Credit Card Companies

Credit Card Companies May Have a Claim on your Parents' Debt

What’s worse, credit card companies have also looked to adult children in order to recover unpaid debts. That’s right. If the parent or elderly loved one has left credit card debt behind and it is unpaid, the company may go after you for payment.

Frequently Asked Questions

Frequently Asked Questions

What is the meaning of filial responsibilities?

Filial responsibility is the obligation and duty of an adult child to support their parent financially, both out of an individual sense of duty and also societal beliefs. It includes providing necessary resources for life necessities such as food, shelter, and medical care. It can also include providing emotional support and companionship.

The concept of filial responsibility is deeply rooted in many cultures and societies, and is often seen as a moral obligation. In some countries, not so much.

What is an example of a filial responsibility?

Filial responsibility is when adult children are considered financially responsible for their parents’ unpaid bills, such as in states with filial responsibility laws applying when a parent lacks the means to pay for their own care.

These laws can vary from state to state, but typically require adult children to pay for their parents’ medical bills, nursing home care, and other unpaid debts. In some cases, the adult child may also be responsible for providing food, shelter, and other necessities for their parent.

What is the filial responsibility law in the United States?

Filial responsibility laws in the US require adult children to provide support for their parents’ basic needs and medical care, commonly known as ‘filial support laws’ or ‘filial piety laws’.

These laws are based on the concept of filial piety, which is a traditional Chinese value that emphasizes the importance of respecting and caring for one’s parents. It is seen as a moral obligation for adult children to provide for their parents in their old age.

The laws are the laws.

Is filial responsibility unconstitutional?

Filial responsibility statutes are not considered unconstitutional, as they do not constitute a taking of private property without just compensation.

How many states have active filial responsibility laws?

26 states and Puerto Rico have active filial responsibility laws.

These laws require adult children to provide financial support to their parents in certain circumstances. For example, if a parent is unable to work due to age, the parent will not be able to work.

Does California Enforce Filial Responsibility Laws? Does Michigan enforce Filial Responsibility Laws?

California is not one of the states that enforce filial responsibility laws. Neither is Michigan. In fact, most states do not have such laws on the books and likely will never implement them. This however could change with the growing aging population.

However, that does not mean you as an adult child should ignore your parents’ medical bills or refuse to help out if they need it.It is important to be aware of your parents’ financial situation and provide assistance as needed.

Professional geriatric care managers can help you with this process by providing support, advice, and resources that are tailored to meet your parents’ needs.

What are Parental Support Laws?

They are court orders issued by a judge that require adult children to provide financial support for their aging parents when the parent is unable to care for themselves. These laws are intended to protect elderly individuals from becoming destitute and also to ensure that they receive the medical attention and resources they need.

The enforcement of parental support laws varies greatly from state to state, but typically these laws are taken into consideration when assessing whether or not an adult child should pay for their parent's medical bills and other needs. In some states, the court may order adult children to pay a specific amount of money each month for their parents' care.

In certain instances, failure to abide by parental support laws can result in legal action including monetary fines or even incarceration. Mental and emotional health are also taken into consideration, as adult children may be ordered to provide companionship or help their parent manage their medical care.

Ultimately, while filial responsibility laws might not be enforced in all states the moral obligation of caring for aging parents should not be forgotten. It is important to understand that providing financial support and other resources for elderly

What are the TN Filial Responsibility Laws ?

The Tennessee filial responsibility laws are similar to other states – courts will only order adult children to provide financial support for an elderly parent if the parent is unable to care for themselves. The court may also consider mental and emotional health when determining whether or not to issue a parental support order. As previously mentioned, failure to abide by these laws can result in fines or even incarceration. In Tennessee, the court may order adult children to pay a specific amount of money each month to help provide for their parent’s necessary needs. It is important to remember that providing financial support and other resources for elderly parents is not just a legal obligation but rather a moral one as well.

It is also important to prepare in advance for potential filial responsibility laws. Estate planning and long-term care planning can help protect adult children from being liable for financial support. These plans can also provide resources and options to assist parents if they become unable to care for themselves in the future.

Ultimately, it is important to understand filial responsibility laws and how they may affect you as an adult child caring for elderly parents. Being aware of these laws and preparing in advance can help you ensure that your parents receive the financial support they may require as well as protecting yourself from any legal action. It is also important to remember that providing financial support for elderly parents is more than just a legal obligation, but rather a moral one as well.

What is the PA filial responsibility laws?

In Pennsylvania, filial responsibility laws require adult children to provide financial support for their elderly parents if the parent is unable to care for themselves. The court may also consider mental and emotional health when determining whether or not to issue a parental support order. As previously mentioned, failure to abide by these laws can result in fines or even incarceration. In Pennsylvania, the court may order adult children to pay a specific amount of money each month to help provide for their parent’s necessary needs. It is important to remember that providing financial support and other resources for elderly parents is not just a legal obligation but rather a moral one as well.

Additionally, preparation ahead of time can help protect adult children from being liable for filial responsibility laws. Estate planning and long-term care planning can provide resources and options to assist aging parents if they become unable to care for themselves in the future. These plans can also help ensure that your elderly parent’s financial needs are taken care of without putting too much of a burden on you, as an adult child.

It is important to recognize that filial responsibility laws can be different from state to state. Therefore, it is important to research the specific laws in your area and prepare accordingly. Understanding these laws as well as the moral obligation of providing financial support for elderly parents can help ensure that you are both protected and helping provide for their necessary needs.

Does NC have filial responsibility laws?

Yes, North Carolina does have filial responsibility laws in place. These laws require adult children to provide financial support for their elderly parents if the parent is unable to care for themselves. The court may also consider mental and emotional health when determining whether or not to issue a parental support order. As previously mentioned, failure to abide by these laws can result in fines or even incarceration. In North Carolina, the court may order adult children to pay a specific amount of money each month to help provide for their parent’s necessary needs. It is important to remember that providing financial support and other resources for elderly parents is not just a legal obligation but rather a moral one as well.

What are Texas filial responsibility laws?

The Texas filial responsibility laws are similar to other states – courts will only order adult children to provide financial support for an elderly parent if the parent is unable to care for themselves. The court may also consider mental and emotional health when determining whether or not to issue a parental support order. As previously mentioned, failure to abide by these laws can result in fines.

Does California Enforce Filial Responsibility Laws?

Luckily, California is not one of the states that enforce filial responsibility laws. Neither is Michigan. In fact, most states do not have such laws on the books and likely will never implement them.

However, that does not mean you as an adult child should ignore your parents’ medical bills or refuse to help out if they need it.

It is important to be aware of your parents’ financial situation and provide assistance as needed. Professional geriatric care managers can help you with this process by providing support, advice, and resources that are tailored to meet your parents’ needs.

Our Resources section can help you find the information and tools that you need. We have courses, videos, checklists, guidebooks, cheat sheets, how-to guides and more.

You can get started by clicking on the link below. We know that taking care of a loved one is hard work, but with our help you can get the support that you need.

Click here to go to Resources Section now!

You might also like this article: