Does Medicaid Cover Long Term Care?

Medicaid is a government-funded health insurance program designed to provide coverage for those who are financially disadvantaged. It is available to individuals and families who meet certain financial criteria, and it pays for a range of medical and long-term care services. Long-term care services are those that are needed by people who have chronic medical conditions or disabilities and need help with activities of daily living, such as getting dressed, bathing, and eating. Medicaid often covers the costs associated with receiving long-term care services but the extent and cost of coverage depend on the individual’s state and financial situation. In this guide, we'll explore more about medicaid coverage for long-term care, including eligibility requirements, types of services covered, and how to find resources and assistance.

Medicaid Overview

Medicaid is a government funded health care program that provides assistance to those who cannot otherwise afford health care coverage. It is a joint federal and state program, each state sets guidelines and requirements for eligibility. Medicaid generally covers individuals who meet certain income and resource requirements.

Medicaid provides a range of different types of coverage including: inpatient and outpatient hospital services, family planning services, laboratory and x-ray services, nursing home care, home health care, doctor’s office visits, prescription drugs and medical equipment.

In addition, Medicaid also provides coverage for long-term care services such as nursing home care, home health care, home and community based services, respite care, and adult day care.

Long-Term Care Defined

Long-term care is assistance or services that people may need when they experience a prolonged physical, mental, or developmental condition. From chronic illnesses to disabilities, long-term care helps individuals with activities of daily living such as bathing, dressing, grooming, and other basic needs. It can also include assistance with managing finances, preparing meals, providing transportation, and much more.

Long-term care can be provided in a variety of settings, including in a person’s home, in assisted living facilities, nursing homes, or even adult daycare centers. The type of care depends on the individual’s needs, their health condition, and type of coverage they have.

Medicaid Eligibility Requirements

Medicaid is a government health insurance program that assists individuals with limited incomes and resources. In order to qualify for Medicaid, a person must meet certain financial and non-financial eligibility criteria. Medicaid coverage for long-term care can include costs associated with nursing home stays, in-home health care, or other services.

When applying for Medicaid, you must provide proof of your household income, assets, and any medical bills or expenses that you have accrued. In addition, you may have to provide information about your living arrangements and health conditions. Your state's Medicaid department will evaluate this information and determine whether you are eligible for coverage.

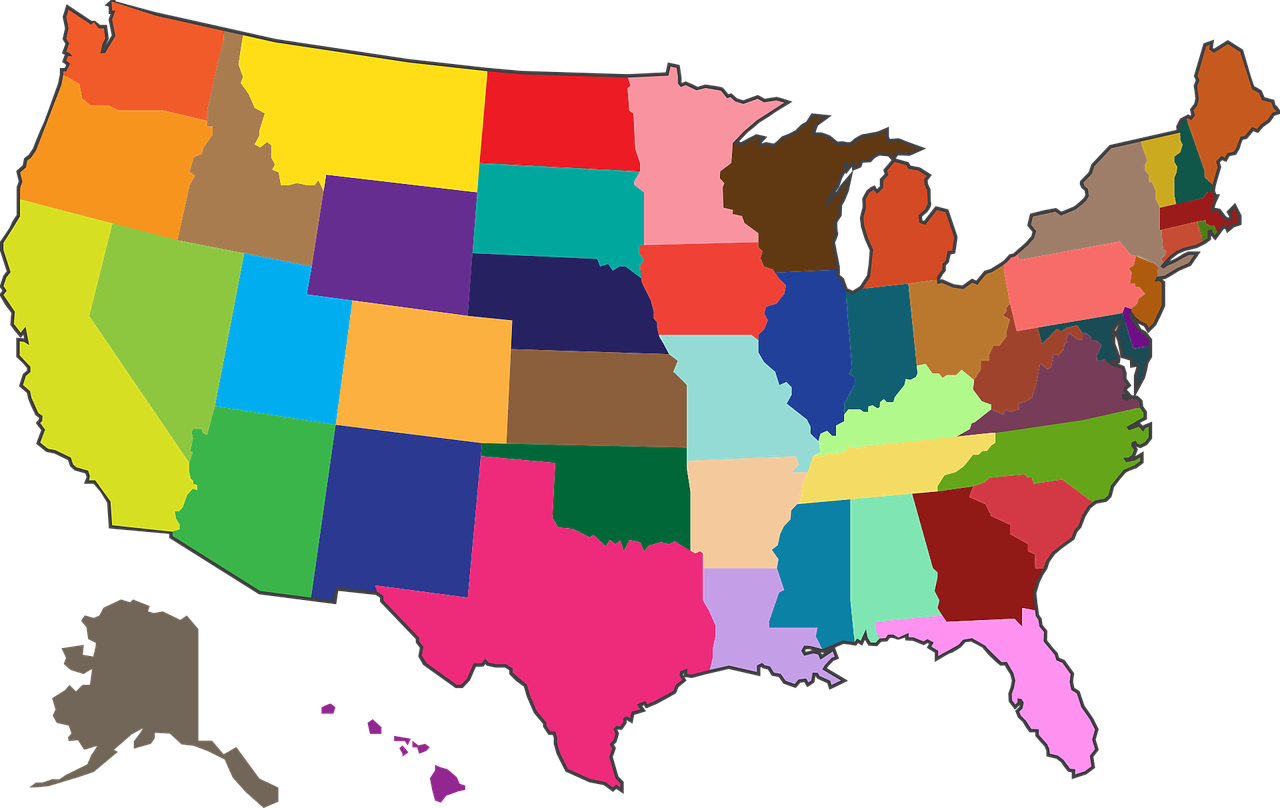

State-by-state eligibility criteria and application processes vary, so it is important to familiarize yourself with the guidelines of your particular state before applying for Medicaid.

Types of Long-Term Care Services Covered

Medicaid covers a wide range of long-term care services, including home health care, nursing home care, and other medical services. Medicaid can also cover personal care services, such as help with activities of daily living, like dressing, bathing, and eating. Depending on the state, medicaid may also cover some non-medical services, such as mental health counseling or respite care. Here is a breakdown of the types of long-term care services typically covered by medicaid:

- Home Health Care - This includes skilled nursing care, physical therapy, occupational therapy, speech therapy, and other medical services.

- Nursing Home Care - This includes 24-hour medically supervised care for individuals with more serious health needs. It may also include hospice care.

- Personal Care Services - This includes assistance with basic daily activities such as bathing, dressing, meals, and housekeeping.

- Non-Medical Services - This includes mental health counseling, respite care, and other support services.

In-Home vs. Facility Care

When it comes to long-term care services, there are two major options available: in-home care and facility care. In-home care is often more tailored to the individual's specific needs and can provide the comfort of being in a familiar environment. On the other hand, facility care provides a comprehensive range of services and may be a more cost-effective option for many people. Additionally, some long-term care services can only be received at an approved facility.

Fortunately, medicaid covers both in-home and facility care services. It is important to understand that medicaid coverage typically varies by state, so it's important to research and understand the specifics of your state’s medicaid program. Additionally, certain service requirements must be met before medicaid will cover either option. For instance, if you’re receiving in-home care, it must be provided by an authorized agency or qualified caregiver.

Pros and Cons of In-Home vs. Facility Care

When deciding between in-home care and facility care, it's important to weigh the pros and cons of each to determine which option is best for you and your family. Here's a quick overview of the advantages and disadvantages of both options:

- In-Home Care:

- Pros: More personalized care, allows individuals to stay in their own home, and can be less expensive in some cases.

- Cons: May be difficult to find qualified caregivers, can be more expensive in some cases, and may be hard to coordinate multiple services.

Costs & Copays with Medicaid Coverage

Medicaid coverage of long-term care costs can vary from state to state, but there are some general rules that apply. Most states require Medicaid enrollees to pay a copayment for services rendered in a nursing home or medical facility. This copayment can range from a few dollars per day to as much as $200 per month. Additionally, Medicaid enrollees may be asked to pay a portion of their own personal care costs. In most states, these costs cannot exceed 5% of the individual’s household income.

Medicaid coverage will typically cover the entire cost of long-term care services if an individual is considered “low-income.” This means that the individual’s yearly income does not exceed the set amount determined by the state’s Medicaid regulations. This low-income designation also usually applies to individuals over the age of 65 or those who are disabled.

It’s important to keep in mind that while Medicaid will cover some of the costs associated with long-term care, individuals must still take steps to plan and prepare for the financial realities they may face. It’s often helpful to speak to a qualified financial planner or other expert when considering this type of coverage.

Assets Impacted by Medicaid Coverage

Medicaid coverage can have a big impact on your assets and finances. It’s important to understand how medicaid works and how it will affect the total cost of care for long-term care services.

When you qualify for Medicaid coverage, the amount of assets you are allowed to keep is limited. This means that if your assets are above the set limit, you may not be eligible for Medicaid coverage.

Any assets that are above the set limit must be spent on care expenses or used to pay back the state of residence before one can qualify for Medicaid. This includes money used for long-term care services.

It’s also important to note that it can take several months for the state to process your application and determine eligibility for Medicaid coverage. During this time, any medical bills that you incur must be paid out-of-pocket.

It’s important to weigh all of these factors when deciding whether or not to apply for medicaid coverage. It’s recommended to speak with a financial advisor or knowledgeable expert in order to understand how medicaid coverage will impact your assets and finances.

Alternatives to Medicaid

Medicaid isn’t the only option available when it comes to covering costs associated with long-term care. There are a variety of other programs and services that can help offset these costs, including federally funded services, state-run programs, and private insurance plans.

Federally funded programs, such as the VA Aid & Attendance Pension, provide financial assistance to veterans and their surviving spouses who require long-term care. To qualify for this benefit, veterans must meet certain eligibility criteria, including income and service requirements.

State-run programs such as Medicaid Waiver programs may be available to patients who do not qualify for traditional Medicaid. These programs provide limited coverage for long-term care services and are administered at the state level. Each state will have its own set of eligibility requirements.

Private insurance plans, such as long-term care insurance, can also be used to cover the costs of long-term care. While these plans are typically more expensive than Medicaid or other government-sponsored programs, they provide comprehensive coverage for a variety of services so they may be a better fit for some. It’s important to review the policy details to make sure that you’re getting the coverage you need.

Finding Resources & Assistance

Finding the right resources and assistance to navigate medicaid and long-term care can seem daunting. Fortunately, there are many reputable professionals who can lend a helping hand in this process. When seeking out professional help, it is important to ensure that the person or organization is certified or licensed by their state’s Department of Insurance.

When looking for community resources, start by calling your local Area Agency on Aging (AAA). The staff at the AAA is usually very knowledgeable about all of the community services available for seniors. Additionally, many states have free helplines that provide information about topics related to long-term care and medicaid coverage. These helplines can also connect you with local professionals who can assist you in navigating these issues.

It is also possible to search online for organizations that specialize in long-term care coverage consultation. Many of these organizations offer free consultations with certified experts who can help answer questions and guide you through the process of understanding medicaid and your long-term care options.

Finally, don’t be afraid to ask family and friends for advice or referrals. Talking to people with similar experiences can be an invaluable resource and can help you find trustworthy professionals who can guide you in making the best decisions for your situation.

There is no one-size-fits-all answer when it comes to understanding medicaid coverage of long-term care. This guide has provided you with an overview of the different types of services covered under medicaid, the eligibility requirements, and the costs associated with receiving those services. As you plan your future long-term care needs, remember to seek out local resources and experienced professionals that can help you navigate the process.

In addition to the information provided in this guide, here are some additional resources that you may find helpful:

-The Centers for Medicare & Medicaid Services: This website includes information about the different types of coverage available through medicaid, as well as the application process for benefits.

-Medicaid Planning Professionals: These experienced professionals can provide you with personalized assistance in understanding and applying for medicaid coverage.

-Local Long-Term Care Facilities: Contact local long-term care facilities to get a sense of the services they provide and how those services could be provided through medicaid coverage.

With these resources and an understanding of medicaid coverage of long-term care, you’ll have what you need to make informed decisions for yourself or a loved one.

You might also like this article: